By: sam doak

February 24 2023

Farage pushes 'Britcoin' conspiracies, and a newsletter subscription

On February 7, Nigel Farage hosted a segment on GB News on the topic of central bank digital currencies (CBDCs) and the Bank of England’s proposal to introduce a “Britcoin” by 2030. He framed the technology as a potential danger to personal freedom and financial autonomy. Farage's guest, Layah Heilpern, an online personality who has previously characterised the COVID-19 pandemic as a "scamdemic," agreed and claimed that CBDCs could result in money being "absolutely in the control of the government and the central bank."

On the prospect of a British CBDC, Farage said, “I think this could pose some real threats – it actually gives government total control over our lives because they can just press a button and close our bank accounts." He concluded the segment by telling his audience he is “not giving investment advice."

This is not the first time Farage has raised the alarm about the so-called dangers of CBDCs. Nor is GB News the only platform through which he has aired these views. Since 2020, he has been a key figure and contributor for Fortune and Freedom, a financial newsletter published by Southbank Investment Research. In recent days, the newsletter and its publisher have not only posted a great deal of content which relies on the same claims and tropes raised by Farage and Heilpern on air — they have also been marketing heavily off them.

Given the reach enjoyed by Farage and others propounding similar views on CBDCs, it is important to clarify whether these views are accurate regarding the United Kingdom's plans.

What the U.K.'s plans for CBDCs Actually Entail

Farage is correct in that the government is exploring the possibility of introducing a CBDC, but the fears raised by the presenter, his guest and associates at Southbank Investment Research do not reflect current plans.

The U.K. does not have a concrete plan for a CBDC; instead, it is engaged in consultations concerning the technology. A final decision regarding its introduction is scheduled for sometime in the middle of the decade.

If a CBDC is introduced, it will not replace the forms of money currently existing in the United Kingdom. A consultation paper published in early February in coordination with The Treasury clarifies this, stating that any digital currency “would sit alongside, not replace, cash – a digital counterpart to familiar, trusted banknotes and coins, subject to rigorous standards of privacy and data protection."

While it does not appear that traditional forms of money will be replaced, it is worth examining whether the U.K.'s CBDC will affect the privacy of those who choose to use it. Economist Dr David Tercero-Lucas, an expert in payments and digital currencies, told Logically, "Privacy considerations are key in the design of a CBDC. All central banks are taking into account these considerations, and they are working on creating, developing and issuing a CBDC with the highest possible degree of privacy."

He added, "the central bank is an independent and autonomous authority separated from the government with no interest in CBDC transactions data."

The Bank of England and The Treasury have stated, "A digital pound would have the same (or stronger) privacy protections as bank accounts, debit cards or cheques.” Noting that, under current plans, the digital currency will be held in digital wallets developed by private companies, they state, “individuals' personal details would not be known by the Government or the Bank of England."

This does not mean that transactions would be completely private. Data will be held by the private companies facilitating payments and storage of funds. Under current plans, however, this information will be anonymised before it is shared with authorities.

According to the Bank of England, "neither the government nor the Bank of England would have access to digital pound users' personal data, except for law enforcement agencies under limited circumstances prescribed in law and on the same basis as currently with other digital payments and bank accounts more generally."

Among the most common conspiracy theories concerning CBDC’s is the claim that they will be programmed to control spending, prevent saving and punish dissent. When asked about such a scenario, Dr Tercero-Lucas told Logically that it is "completely unlikely that a CBDC would be used to control spending in democratic countries."

In response to a petition circulated in opposition to programmable CBDCs, the government has gone into more detail, stating, "Neither the Bank of England nor the government would be able to program CBDC or restrict how money is spent. If there was end-user demand for programmability features, then any programmability features would be designed by the private sector wallets, and users would have the option to use them if they so wished."

While it is clear that the U.K.'s CBDC is not being developed as a tool for state oversight and control, the real rationale for its development is relatively complex. A key factor is reportedly the desire to prevent private companies from creating their own versions, each with varying spending power. On this, the Bank has stated that "the digital pound could support the uniformity of money by replicating the role of cash in a highly digitalised economy." Aside from this, Dr Tercero-Lucas told Logically that "domestic payments efficiency, payments safety, and financial stability considerations” are all factors that could make a CBDC an attractive proposition to a country like the U.K.

Efforts to Capitalise on CBDC Fears

If you visited the website for Fortune and Freedom on February 10, an ominous message would have popped up. "A new form of financial surveillance technology could 'track and trace' your financial behaviour," it warned. “Rishi Sunak is a big fan. And it gives the government the capability of ultimate control over your financial freedom."

A previous iteration of this pop-up, viewable earlier in the week, carried a similar message, warning of "worrying risks to your money, privacy and freedom." Both directed viewers to a link leading to a promotional blog post written by Nick Hubble, who edits Fortune and Freedom, among several other newsletters published by Southbank Investment Research.

Screenshot from Fortune and Freedom website, taken 10/2/2023

In this lengthy post, Hubble warns of ‘financial martial law’ and hits upon many of the same fears raised in Farage's GB News show. According to Hubble, CBDCs could be used to “track and control your money,” “limit the amount of carbon you and your family use,” and result in “money that expires unless it’s spent.”

For Hubble, the Chinese government’s decision to use CBDC technology is a key reason to be suspicious of it. However, the political and regulatory environments of the U.K. and China differ markedly. China’s CBDC is programmable, and its central bank led the development of its currency's digital wallets. The Bank of England, meanwhile, intends to delegate the creation and maintenance of "Britcoin" wallets to private sector companies and has strongly refuted any notion the currency will be programmable by the State.

Given how alarmed Hubble appears to be over the prospect of a British CBDC and the supposed "techno-communist" origins of this technology, one would perhaps expect him to urge readers to resist it through protests, petitions or the ballot box. Instead, he concludes with a pitch.

"The first thing we want to send you is a crucial online workshop called The Fleet Street Letter Guide To Surviving CBDCs," Hubble writes, "you'll see Nigel’s take on the threat they present to you and your money."

Aside from this, he prescribes two guides on getting money "off grid" and invested in gold and a subscription to a newsletter called The Fleet Street Letter. The cost of this package? Usually, £199 annually, though now available at a promotional price of £99.

"Practically giving this away," Hubble remarks.

Screenshot from Fortune and Freedom website, taken 13/2/2023

On February 10, Fortune and Freedom posted a video of Nigel Farage and Nick Hubble discussing CBDCs. The points addressed were much the same as those touched upon in Farage’s interview with Layah Heilpern. Farage, much like Heilpern, warned his audience that CBDCs could be used to penalise those not in compliance with government policy and prophesied that as “climate hysteria continues,” the technology could be used to enforce carbon credits.

CBDCs and Conspiracy Theorists

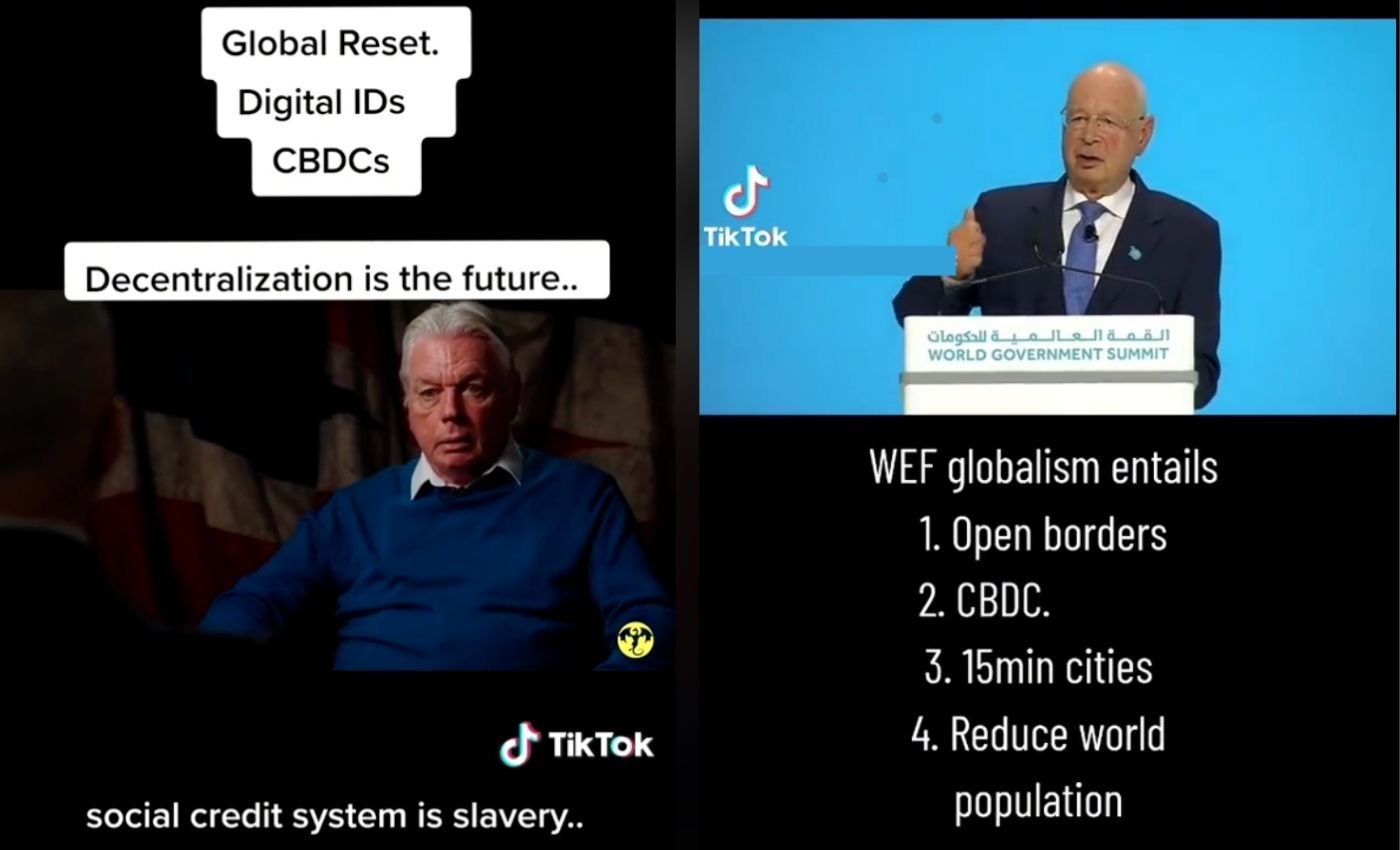

Nigel Farage is not alone in claiming that the U.K.'s CBDC will likely be used as a tool of state repression. Variations of this conspiracy theory have been put forward by several high-profile fringe figures in recent months, including Russell Brand and David Icke. Part of the appeal of this narrative in fringe spaces is how well it fits with prevalent conspiracy theories, particularly the Great Reset.

As Logically has previously reported, conspiracy theorists believe that the Great Reset is a sinister plan by elites to overturn social, economic, and legal norms on a global scale under the guise of addressing climate change, inequality, and public health concerns.

While Farage's comments on CBDCs have not engaged explicitly with the Great Reset, his rhetoric on this topic has resembled David Icke's. As recently as late last year, Icke described the threat of digital currencies in the following terms: "I could see that the plan was in this great reset… to introduce a digital currency controlled by the system so that they can just take what they want. If you're fined, you can't challenge it. They can just take it like in China. That's the whole point."

When evaluating the impact of this technology, Heilpern warned Farage's audience that the technology could be "used against" those who refuse vaccines and leveraged to "implement a carbon allowance," two scenarios completely at odds with Bank of England's stated positions concerning privacy, programmability and control of digital wallets.

Heilpern summarised her position by stating that CBDCs are "a really efficient way for governments to implement their political and woke agendas, through the money." Farage, who did not challenge her on these claims, concluded the segment by telling his audience, "I can see that: if central bank digital currencies come fully within the next decade, a lot of people will go for other options."

Screenshots from two TikTok videos from conspiracy theory accounts featuring false Great Reset narratives from David Icke, taken 13/2/2023

Under current plans the U.K. is not due to have a CBDC in the near future. According to The Treasury and Bank of England, "a decision about implementing a digital pound will be taken around the middle of the decade and will largely be based on future developments in money and payments. The earliest stage at which the digital pound could be launched would be the second half of the decade."

In the meantime, conspiratorial narratives concerning CBDCs will likely grow in prevalence. The technology is complex, plans are far from concrete, and people are rightly sensitive to news they believe could affect them financially. This provides ample space for speculation to take hold and opportunists to capitalise.

Nigel Farage, GB News and Southbank Investment research did not respond when approached by Logically for Comment. In November 2022, Bloomberg was able to briefly reach Farage by telephone and ask about his relationship with Southbank Investment Research. According to the outlet, he responded, "I don't give advice. That's very important. I don't give advice," at which point the line disconnected.