By: Devika Kandelwal

August 25 2020

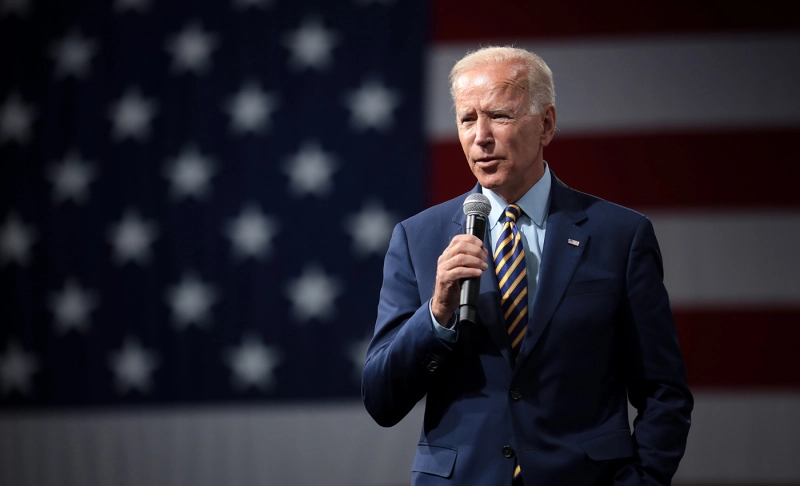

Misleading: Joe Biden wants to raise taxes on 82% of Americans.

The Verdict Misleading

Increase in corporate tax could lead an indirect tax rise for middle-class taxpayers who might have to pay $180-$200 more every year.

Increase in corporate tax could lead an indirect tax rise for middle-class taxpayers who might have to pay $180-$200 more every year.On the first night of the RNC, Ronna McDaniel, the chairwoman of the Republican National Committee, claimed that Joe Biden wants to raise taxes on 82% of Americans. This claim is based on Joe Biden’s tax plan. Joe Biden, the Democratic nominee for president, has previously stated that he would not raise taxes on anyone making less than $400,000. If elected, he plans to roll back President Trump’s tax cuts on households making above the $400,000 threshold and on corporations. Trump’s tax law reduced the income tax on the wealthiest Americans from 39.6 percent to 37 percent. Washington Post reported that Trump and Republicans in Congress also enacted the most significant corporate tax cut in U.S. history, by slashing the corporate tax rate from 35 percent to 21 percent in 2017. If elected president, Biden has vowed to raise the corporate tax rate to 28 percent. While Joe Biden said that under his tax plan, taxes would not be raised for people earning less than $400,000, CNBC reported that studies from the Tax Policy Center and the Tax Foundation show that his plan could raise middle-class taxes slightly. As workers usually end up paying some portion of higher corporate taxes, they suggest that middle-class taxpayers could see a tax increase of between $180 and $200 a year. However, the Tax Policy Center estimates that the top 1 percent of the wealthiest households would pay three-quarters of the tax increases. The Tax Foundation found that Biden’s plan could also reduce long-run economic growth by 1.51 percent and eliminate about 585,000 full-time equivalent jobs. Therefore, McDaniel claims that more than 80 percent of Americans would face higher taxes but that's misleading. Biden’s tax plan will lead to the richest 1 percent bearing much of the tax burden, which some indirect effect of the increase in corporate tax of middle-class taxpayers. Moreover, the exact number of Americans who will have to pay higher taxes remains unclear.